Photo from www.lazyzebra.com

Photo from www.lazyzebra.com

The Internal Revenue Service (IRS) is already accepting paper and electronically filed returns. They started processing last Tuesday – January 19, 2016.

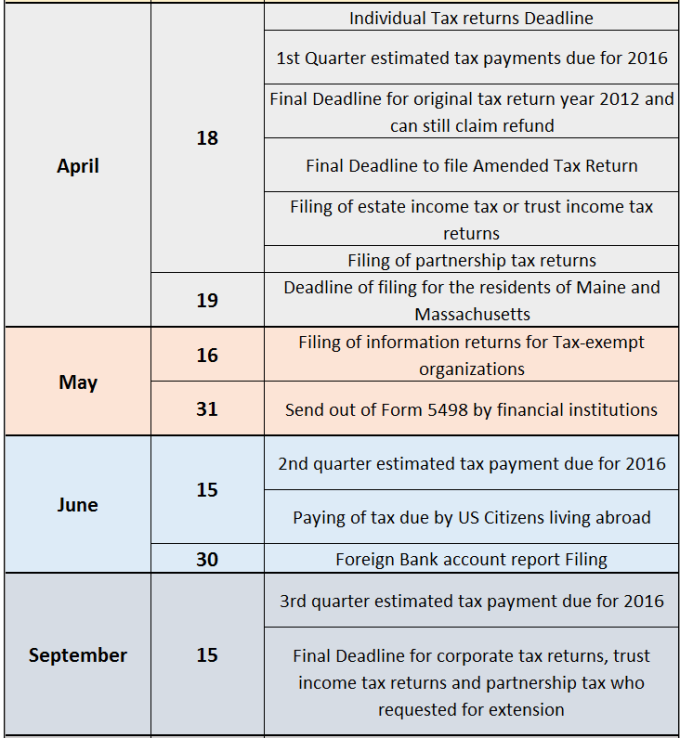

Here is the complete timeline of deadlines for the year 2016.

Source: Income Tax Deadline

Source: Income Tax Deadline

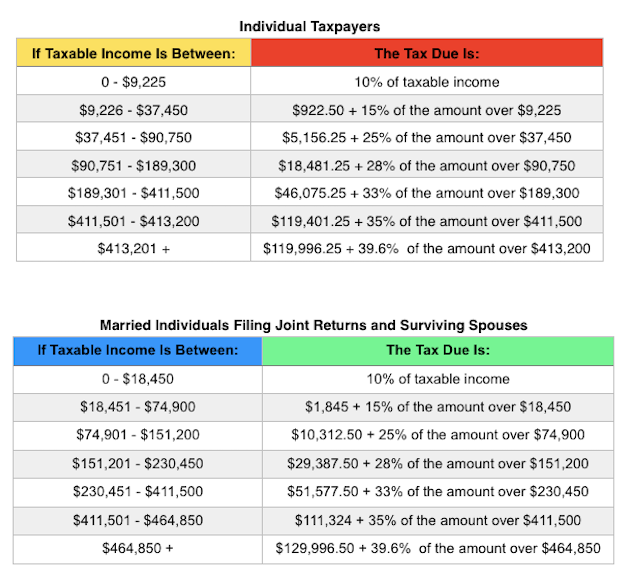

Take note that we’ll be filing tax returns for the year 2015 and so we will be using the 2015 Tax Rates. See below for information about 2015 Tax Rates.

Source: 2015 Tax Rates

If you’re looking for 2016 Tax Rates, Click Here

For other things you need to know about taxes, Forbes Staff Kelly Philips Erb have enumerated these 10 important reminders:

- You may not have to file a federal income tax return

- Even if you don’t need to file a federal income tax return, you may still want to take advantage of tax breaks and credits

- You don’t have to itemize to take advantage of certain deductions like the student loan interest deduction

- if you’re self-employed, you likely need to make estimated payments

- You should file a return even if you can’t pay your tax bill.

- Due dates matter

- An extension of time to file is not the same as an extension of time to pay.

- Once the year-end passes, you still have one more opportunity to reduce your tax bill

- If you fail to file and pay, the government can take some pretty drastic measures – even seizing your passport

- A good tax preparer doesn’t have to break the bank

To read the full article, click here.

Here are some good reads about Taxes:

- Ten Useful Tips in Filing your Tax Returns

- Tips for Filing Late Tax returns

- Paper of E-File your Tax Returns

- Filing your Taxes

- Which Tax Form Should I file?

Now that you have take note of the deadlines, remember the tax rates and know some important reminders, Its time for you to get ready and prepare your tax returns. You would not like to miss the deadlines.